How To Register Kra Itax Pin Online

Yarab A| Updated on: Oct 27, 2021

The tax obligation nether various Kenya Act requires businesses or individuals to register nether KRA iTax Portal. Registering under KAR iTax portal enables the taxpayers to file the returns and make the tax payments. To exist called a registered taxpayer, y'all should use for PIN registration. While applying for the KRA PIN, you lot will be required to select the tax obligation applicative to you.

Read 'KRA' iTAX Returns' to know unlike taxation obligations in Kenya

What is KRA PIN?

A PIN is a Personal Identification Number used for doing concern with Kenya Revenue Authority, other Government agencies and service providers. The KRA PIN will exist issued once you consummate the online Pivot registration. The steps to obtain KRA iTax PIN are detailed in the department below.

Who should have a Pin?

Based on the revenue enhancement obligation applicative on y'all, you are required to accept a Pivot if y'all are:

- Employee

- Business

- If y'all Have rental income

- Wish to utilise for a HELB Loan

- Want to perform a certain type of transactions listed in the first schedule of the Act.

How to Register for KRA Pin in iTax Portal

For you to obtain a KRA PIN, you lot need to utilise for PIN registration in KRA iTax Portal. The following are steps to annals for KRA Pivot in iTax Portal.

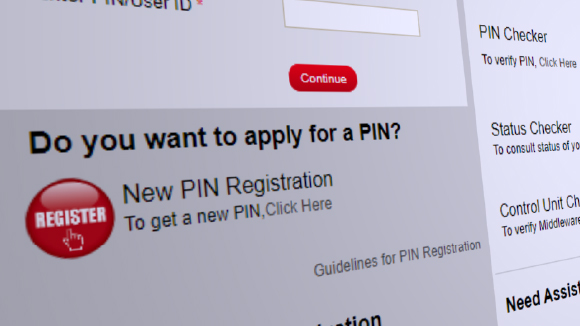

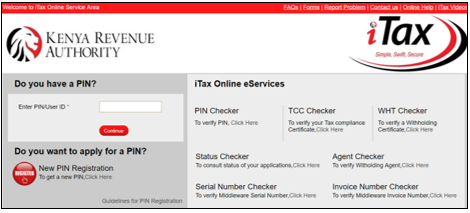

- Visit KRA iTax Portal using https://itax.kra.get.ke/KRA-Portal/

- Select "New PIN Registration" in the homepage of KAR iTax Portal.

Select the Taxpayer Blazon (Individual or Non-individual) and Way of Registration (Online or Upload form) in e-Registration form as shown in the below.

- Based on the taxpayer type and registration mode, iTax Pin registration grade will open up. The type of details to be furnished in the Pin registration form are dissimilar for individual and Non-private.

- For Non-individuals, the Pin registration class consists of four wide categories listed below:

- Basic Information

- Obligation

- Director Associates

- Agent Details

- Y'all need to replenish all the mandatory details along with the required supporting documents and submit the KRA iTax Pivot registration form

- On submitting, a popular-up to confirm the email ID yous had mentioned in the PIN registration class. You can confirm by clicking 'OKAY' if the ID is right

- On successful submission of the iTAX PIN registration grade, iTAX PIN will be displayed immediately on the iTax page. You lot can also download it and print. Another copy of your iTAX Pivot will be mailed to your ID

Creating Your iTax Login Countersign

On successful submission, login to your email and you lot will find your iTax Pivot and password generated past KRA iTax Portal. Visit KRA iTax Portal and mention the iTax PIN and countersign you have received. On mentioning, you volition be re-directed password change folio. Here, you can change the password and likewise you lot need to create a security question which will help you to recover your iTax profile.

Knowing these five Things you can practise from your iTAX Portal will be helpful in using your iTax profile.

Documents required for iTax PIN Registration

A company applying for New PIN registration

The following are documents required to be submitted past a company applying for new PIN registration:

- Copy of Document of Incorporation

- Re-create of CR12(a legal certificate list shareholders or directors of the company)

- Copy of Memorandum and Commodity of Association (optional)

- Copy of Pivot Document for one of the company's directors

- Copy of Revenue enhancement Compliance document of 1 of the company'southward directors

- Copy of the Acknowledgement Receipt

Partnership firm applying for New Pivot registration

The following are documents required to be submitted by a partnership business firm applying for New PIN registration:

- Copy of the Acknowledgement Receipt

- Pin Certificate for one of the partners

- Deed of the partnership (optional)

- Tax Compliance document of the partners (optional)

FAQs on KRA Pin registration

- How can I get my KRA Pivot online?

For you lot to obtain a KRA PIN, you demand to apply for PIN registration in KRA iTax Portal.

- How much does information technology cost to apply for KRA Pivot?

You just demand to register online and apply for a KRA Pivot

- How long does it take to get KRA PIN?

On successful submission of iTAX PIN registration grade, iTAX Pivot volition be displayed immediately on the iTax page. You can also download it and print.

- How do I register my KRA Pin to iTax?

You demand to visit KRA iTax Portal using https://itax.kra.go.ke/KRA-Portal/ and select "New Pivot Registration" on the homepage of the KAR tax Portal.

Read more on TallyPrime Kenya

What is TallyPrime, TallyPrime'southward 'Go To' Characteristic, TallyPrime'due south Simplified Security and User Direction Arrangement, Tally'southward Exception Reporting to Accost Data Anomalies, v Things You Can Do Using Save View Option in TallyPrime, five Things in TallyPrime for Enhanced Business organisation Efficiency, Analysing Business Reports Just Got Easier with TallyPrime, Personalise the Business Reports the Way You Want

Software in Kenya

Payroll Software in Republic of kenya, All-time Inventory Direction Software for Businesses in Republic of kenya

iTax in Kenya

iTax in Kenya, KRA VAT Return, How to Brand KRA iTax Payment, How to File VAT Returns in iTax Portal, How to File KRA iTax Returns Online in Republic of kenya, KRA iTax Returns & Types of KRA Returns Forms, v Things yous tin can do from your KRA iTAX Portal, Compliance in Kenya

How To Register Kra Itax Pin Online,

Source: https://tallysolutions.com/ssa/vat/how-to-register-for-kra-pin-in-itax-portal/

Posted by: kawamotowarmen.blogspot.com

0 Response to "How To Register Kra Itax Pin Online"

Post a Comment